The total installed capacity of China's electrical machinery has reached more than 400 million kW, annual power consumption of 1.2 billion kWh, accounting for 60% of the country's total electricity consumption, accounting for 80% of industrial electricity consumption, including the installation of fans, pumps, and compressors. The total capacity has exceeded 200 million kW, and the annual power consumption has reached 800 billion kWh, which accounts for about 40% of the total electricity consumption in the country. Therefore, the energy-saving requirements on the motor are very large, and the energy-saving effect is also the best expression; currently, it reaches Level 2 The proportion of the energy efficiency index motor is less than 10%, and the development space is extremely wide.

With the active implementation of the national energy-saving emission reduction and the gradual implementation of the energy-efficient motor subsidy policy, the highly efficient and energy-saving motor industry will usher in explosive growth. China's new energy automotive industry will usher in a rapid growth phase in the coming years, and this will drive the rapid growth of the drive motor market. In the coming years, the ratio of energy-saving motor equipment to domestic newly-added small and medium-sized electromechanical equipment will reach over 60%, and the market size of energy-saving electromechanical equipment will reach around 50 billion yuan.

The motor industry, as the most widely used electrical equipment, is an important part of China's manufacturing industry. At present, the technology of China's ordinary motors has matured. With the improvement of the technological level of enterprises and the continuous absorption of advanced foreign technologies, the future motor industry will also be highly efficient. The development of higher goals such as sex, high reliability, lightweight, miniaturization, and intelligence.

Industry Analysis Report Statistics

Including vehicle manufacturers, auto parts manufacturers, and professional motor companies, there are about 30 companies currently involved in the field of new energy automotive drive motors. Among them, Shanghai Electric Drive is the leading company in the drive motor for new energy passenger vehicles, and it accounts for 50%-60% of the domestic new energy automotive motor and electronic control market.

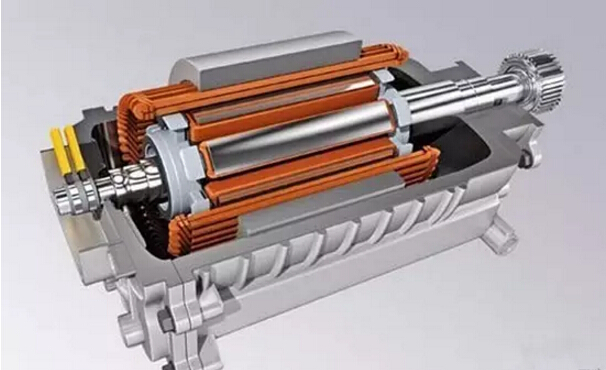

At present, China's new energy vehicles drive motors mainly include permanent magnet synchronous motors, DC motors, AC asynchronous motors, and switched reluctance motors. New energy automotive drive motors are facing challenges of safety, efficiency and low price, which determine the future development and competitiveness of new energy vehicles. Permanent magnet synchronous motors have great space and advantages in improving efficiency. Permanent magnet synchronous motors can save energy by more than 20% compared with asynchronous motors. At present, except for Tesla, permanent magnet synchronous motors have been used for new energy automotive motors from manufacturers such as BMW, Volkswagen, Toyota, Nissan, and BYD. Although the permanent magnet synchronous motor is currently the most mature technology in Japan, China has the resource advantages of rare earth permanent magnet materials, which can reduce the production cost of new energy vehicle motors.

As China's support policies for new energy vehicles gradually come to the ground and market demand continues to grow, new energy vehicles will become a new direction for the development of the motor industry. At the same time, it will also be a new opportunity and new challenge for the development of China's motor companies. It is estimated that by 2020, the market size of new energy automotive motors will reach 30.6 billion yuan.

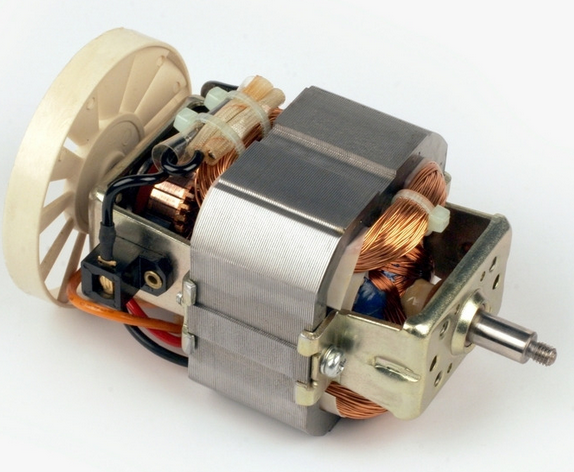

As the world’s largest automobile manufacturing and consumption country, China’s auto industry will maintain a compound growth rate of 10%-15% in the next 5-10 years. With the further increase in the degree of automotive electronics, the growth rate of the automotive micromotor market capacity can be increased. Long-term maintenance above 15%. In addition to the automotive industry, in areas such as household appliances, cosmetics for daily use, aerospace, industrial networking, and cloud computing, the demand for micro-motors is increasing day by day. It can be seen that the development prospects of micro-motor market in China are promising. .

As an important device for electromechanical energy conversion, motors are the basic components of electric drives. They have a wide range of applications, a wide variety of products, and a variety of specifications. Their product characteristics determine that the industry is not highly concentrated, and that there are many sub-sectors involved in the production industry. No obvious cyclical, regional, seasonal features. At present, the production and supporting manufacturers of domestic differential and small and medium-sized motors are more than 2,000, and have become an indispensable basic product in the national economy and national defense modernization. In order to achieve high-quality, high-efficiency, and low-cost operation, small and medium-sized motors are connected to computers, motor controllers, power converters, sensors, etc. in a variety of different operating conditions, and are usually associated with the following agencies. Loads (such as various mechanical, hydraulic, pneumatic equipment) are combined.

At the same time, domestic differential and small and medium-sized motor industries have a large number of manufacturers. The market competition is mainly reflected in the product's technical content, price, and production scale. Due to the imperfect market mechanism, the industry’s price competition is fierce, and it is already benign to the industry. Development has a negative impact. With the enforcement of the energy efficiency label of the motor, the manifestation of the role of the market in the survival of the fittest, and the further enhancement of the industry barriers to entry, the impact of price competition will gradually weaken.

Non-industrial motor applications have always been the driving force of the motor industry. The automotive industry is the main buyer of non-industrial motors, with light vehicles averaging more than 30 motors per vehicle. The use of electric motors in home appliances and residential (heating, ventilation, and air conditioning) products, for example, uses more than 450 million refrigerators and washing machines each year; each computer uses 3-6 small motors for disk drives and ventilation fans. Compared to the growth of home appliances, residential HVAC systems are expected to drive faster motor growth. The economic recovery is a big environment, policies are the driving force, and the market is the driving force. Grasping the direction of the industry and combining policy indicators is a new situation for the motor industry market.

Although China has gradually become a major motor manufacturer and has mastered efficient and ultra-efficient energy-saving motor production technologies, the overall competitiveness of the industry remains weak. Nowadays, the proportion of high-efficiency motors in domestic existing electric motors is less than 5%, and the proportion of applications in China is currently only 23%~25%. Its highly efficient motors are mainly sold abroad. As fewer and fewer enterprises in developed countries in Europe and America engage in traditional motor production, China’s motor companies have become their importers. Large motor usage and low energy efficiency. In recent years, although our country has basically kept pace with the international level in the research and development of high-efficiency motors, technological progress is very optimistic. But unfortunately, the IE3 motor produced in our country has been used too little domestically, and most of it is used for export. It is not difficult to see that China still has enormous challenges in terms of high-efficiency motors. In the future, on the one hand, we must conduct in-depth studies on the energy-saving technologies of motors and their systems. On the other hand, it is necessary to formulate guidelines and standards for energy conservation in motor systems, such as guidelines for energy-saving retrofitting of systems, and energy-saving detection and evaluation standards for motor systems in specific fields. In addition, we must establish energy-saving certification agencies for motor systems, such as market access certification, energy-saving product certification, and various types of high-efficiency motor system energy-saving certification.

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite