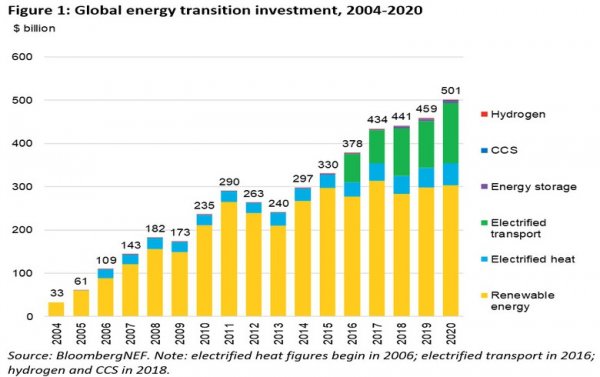

According to BNEF's latest market analysis, despite the impact of COVID-19, spending on energy transition has increased by 9% in 2020. Investment in renewable energy alone reached US$303.5 billion, an increase of 2% year-on-year, while investment in electric vehicles and related charging infrastructure reached a record high of US$139 billion. The energy storage industry accounted for 3.6 billion US dollars, of which 1.5 billion US dollars flowed into the hydrogen energy sector, and investment fell 20% year-on-year.

Geographically, Europe ranked first with 166.2 billion U.S. dollars in energy transition expenditures, an increase of 67%; followed by China at 134.8 billion U.S. dollars, a decrease of 12%; the United States was 85.3 billion U.S. dollars, a decrease of 11%.

Falling asset costs are the main growth driver for global renewable energy investment. Solar power generation capacity has increased by 132GW, and wind power generation capacity has increased by 73GW. Investment in offshore wind energy soared by US$50 billion, an increase of 56% year-on-year, while the construction of the largest solar project in history promoted a 12% increase in solar power investment to US$148.6 billion. Biomass and waste-to-energy financing decreased by 3% to USD 10 billion.

The main players in the field of renewable energy are China and Europe, with investments of US$83.6 billion and US$81.8 billion respectively. The top five countries also include the United States, with a total investment of 49.3 billion U.S. dollars, and Japan's investment of 19.3 billion U.S. dollars.

Public market investment in professional clean energy companies soared to a record US$20 billion, and investment in venture capital (VC) and private equity (PE) increased by 51% to US$5.9 billion.

In 2020, electric vehicle companies raised approximately US$28 billion from stock market investors, compared with only US$1.6 billion in 2019.

Albert Cheung, BNEF's head of analysis, pointed out that the inflow of clean power generation and power transportation is very large, but more funds are needed to help control emissions. "If we are to achieve climate goals, we may need trillions of dollars in investment every year," he said.

Another positive aspect is that BNEF CEO Jon Moore stated that 54% of emissions in 2016 were achieved under some form of net zero commitment, up from 34% in early 2020. This means that investment in the next few years is expected to increase further.

A statistical chart of global energy transition investment from 2004 to 2020. Image: BNEF

Article information source-Renewable Energy Express China New Energy Network Comprehensive

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite