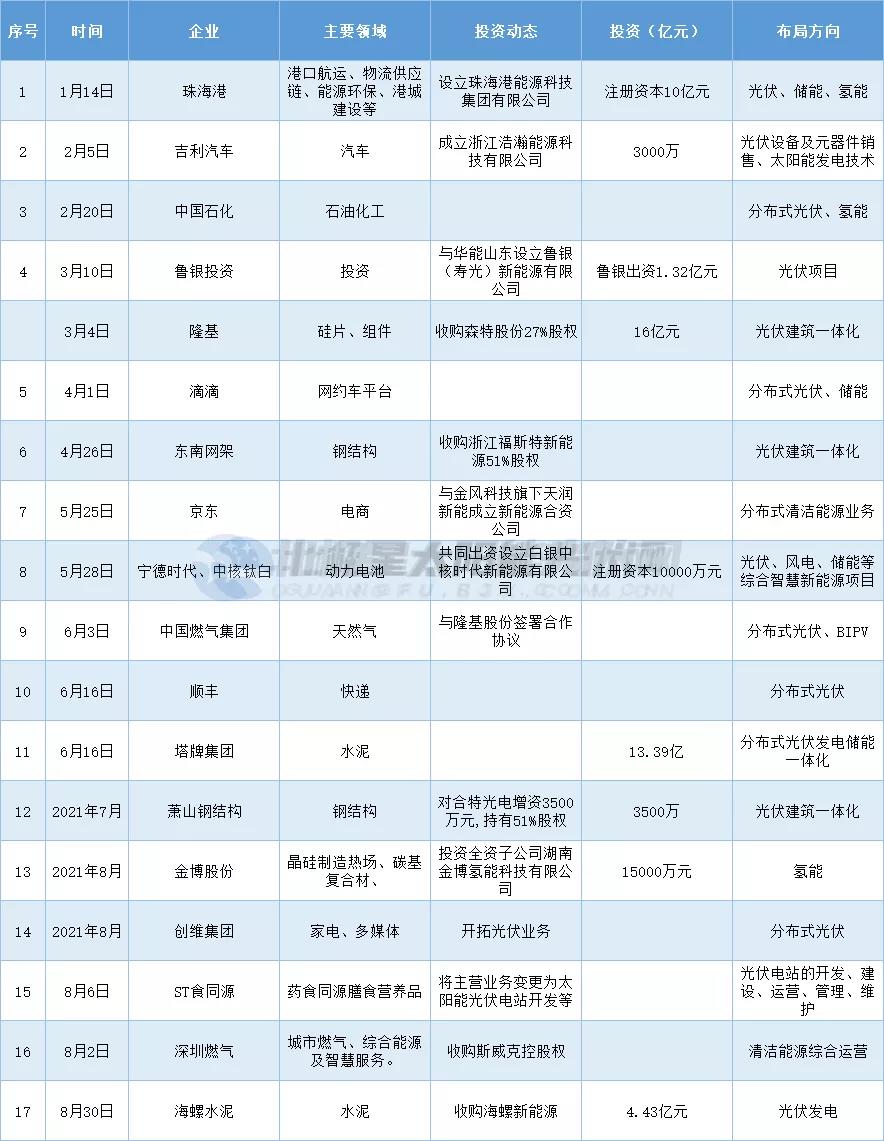

According to statistics from Polaris Solar, 29 companies have entered the photovoltaic industry with a huge amount of more than 24.1 billion yuan in just over 8 months from 2021 to the present.

Among these companies, there are many such as e-commerce giants JD.com and Didi, express delivery giant SF Express, cement giants Tower Group, Conch Cement; steel structure leader Southeast Grid, Xiaoshan steel structure; shoe industry giant Baofeng Fashion, home appliance leader Skyworth Group; more traditional energy companies such as Sinopec and Shenzhen Gas flock to the photovoltaic industry.

Shoe king, glass, wind power giants get together raw and auxiliary materials

Polysilicon, silicon wafers, and photovoltaic glass are the most profitable links in the photovoltaic manufacturing industry chain since the second half of 2020, and are favored by cross-border giants. According to statistics, since 2021, 10 companies have announced investment in the field of photovoltaic raw materials. Among them, 4 companies have entered the photovoltaic glass industry, 3 companies have joined the battery and module track, and 1 company has deployed low-cost polysilicon.

From the perspective of the layout of all links in the industry chain, the companies that cross-border investment in upstream silicon materials and wafers are the civil explosion giant Tongde Chemical and the shoe industry king Baofeng Fashion. Among them, Tongde Chemical plans to invest 299 million yuan to establish a partnership with Shenzhen Butterfly Valley Capital and others to invest in Shanxi Rocky Mountain Photovoltaic Energy Technology Co., Ltd., which uses silicon mud as raw material to develop low-cost photovoltaic-grade polysilicon. The shoe industry king Baofeng has the most thorough cross-border fashion. On July 28, it officially announced that it was renamed Jinyang New Energy and joined the photovoltaic industry. It has made ingot monocrystalline solar wafers and has signed 400 million wafers with downstream companies. Long-term orders, the transformation has begun to bear fruit.

Cross-border investment volume The largest part of investment volume is batteries and components. Among them, the largest investment amount is China Resources Power, which plans to invest 11 billion yuan to build a 12GW heterojunction battery and module project. Next is the wind power giant Mingyang Intelligent, which plans to invest 3 billion yuan to build an annual output of 5GW battery and 5GW module projects. The technical route is also optimistic about the heterogeneous junction with iterative strength, and the layout of the future competition track. Xingshuaier, an electrical machinery manufacturing company that is also optimistic about the component track, quickly entered the photovoltaic field by acquiring a 51% stake in Huangshan Fule New Energy, opening up new markets, and seeking new profit growth points.

The most investment-intensive link in the photovoltaic chain is photovoltaic glass, which not only attracts Fuyao Glass, the "king of glass" with deep glass industry background and financial strength, and Konkaxin, the leading nanocrystalline stone leader, as well as Feite and Zhifeng special glass companies. .

In addition to the above-mentioned companies that are optimistic about the crossover of photovoltaic manufacturing into photovoltaics, the companies on the photovoltaic track are also expanding their tentacles in order to accelerate the integrated business layout. Canadian Solar, which ranks fifth in module shipments in 2021, has deployed a 3GW inverter project, and the degree of vertical integration continues to deepen, which will not only reduce Canadian Canadian procurement costs, but will further improve Canadian Canadian's control over the industrial chain. ability.

E-commerce, electrical appliances, express delivery, and petrochemical giants poured into power station development

In the context of the national strategic goal of “carbon peak and carbon neutrality” and the grand installation of the “14th Five-Year Plan”, the photovoltaic power generation industry has ushered in a new round of development boom, attracting a large number of heavy players to enter the game, distributed, photovoltaic Building integration and hydrogen energy have become key layout directions.

In terms of industries, e-commerce, express delivery, home appliances, and petrochemical companies are closest to the terminal market, and their layout is mostly distributed photovoltaics. For example, e-commerce leader JD.com has joined hands with wind power leader Goldwind Technology subsidiary Tianrun New Energy to establish a new energy company with a focus on distributed clean energy business. SF Holdings mentioned in the "Carbon Target White Paper 2021" that it plans to achieve a carbon reduction target of 68% through the adjustment of energy use structure, and will invest in the construction of photovoltaics in suitable industrial parks to change the type of energy use. The home appliance leader Skyworth Group announced the latest photovoltaic business for the first time in the 2021 semi-annual report, with a revenue of 829 million yuan, taking distributed photovoltaic as its early main business. During the "14th Five-Year Plan" period, Sinopec plans to use hydrogen energy as its core new energy business, planning to deploy 1,000 hydrogen refueling stations or oil-hydrogen combined construction stations, and 7,000 distributed photovoltaic power generation sites.

Leaders in the steel structure and roof engineering industries favor the BIPV rooftop photovoltaic market, and mostly acquire and invest in the leaders of the photovoltaic subdivisions to give full play to the industrial synergy capabilities of the two parties and cut into the photovoltaic industry. Among them, the steel structure leader Southeast Grid acquired 51% of the equity of the film leader Foster New Energy in cash; Hangxiao Steel increased its capital by 35 million yuan in the photovoltaic power generation research and development company Hete Optoelectronics, established a BIPV subsidiary, and built a BIPV production line . Longji, the leader in photovoltaic silicon wafers and modules, acquired 27.25% of Sente shares for 1.63 billion yuan, accelerating its deployment in the rooftop photovoltaic market.

As a major carbon emitter, the cement industry is under tremendous pressure to reduce carbon, and low-carbon production is imminent. Recently, the traditional cement leader Tower Group and Conch Cement have announced their entry into the field of photovoltaic power generation. Tapai Group plans to invest about 1.339 billion yuan in three integrated projects of distributed photovoltaic power generation and energy storage. "Cement Mao" Conch Cement acquired 100% of Conch New Energy, which is mainly engaged in photovoltaic power generation, for 443 million yuan. This will not only provide power support for cement production, but also benefit the diversified development of the enterprise.

It is worth mentioning that, in order to break through the bottleneck of the original business development, ST Foods in the food industry is betting on photovoltaics and changing the main business to the development, construction and operation of solar photovoltaic power plants, hoping to improve sustainable operation and profitability through business transformation .

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite