Although the shipping industry has experienced a difficult period in the past 10 years, from 2009 to 2018 after the financial crisis, the shipping industry's investment in newbuildings and used ships still exceeds 1 trillion US dollars, the traditional three major ship types - Bulk carriers, oil tankers and container ships are still the largest investment targets in the market, while Greek ship owners and Chinese ship owners rank in the top two in terms of investment amount.

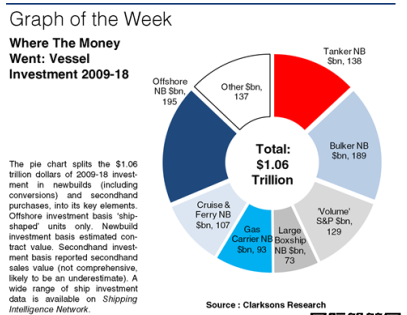

According to a recent report from Clarkson, from the beginning of 2009 to the end of 2018, the value of new global shipbuilding contracts plus second-hand ship transactions totaled $1.06 trillion (about RMB 6.88 trillion), including $873 billion. New shipbuilding investment and $189 billion in second-hand boat investment.。Undoubtedly, a large part of the investment is mainly concentrated in the oil tankers and bulk carriers. In fact, the total investment in newbuilding contracts for tankers and bulk carriers is as high as $327 billion, accounting for approximately 31%. Among them, the new shipbuilding investment of bulk carriers is about 18%, and the proportion of oil tankers is about 13%. In addition, the investment in second-hand vessels in these two ship types totaled approximately US$129 billion, accounting for approximately 12%. In addition, the new shipbuilding investment of 8000 TEU and above container ships totaled 73 billion US dollars, accounting for about 7%. The above-mentioned investment in the traditional merchant shipping sector accounts for about half of the total investment in the past 10 years.

On the other hand, investments from “niche markets” also account for a very large share, including high-value assets. The total investment in newbuildings for liquefied gas carriers is about US$93 billion, accounting for about 9%. New shipbuilding investments in passenger ships and cruises totaled approximately $107 billion, accounting for 10%. At the same time, despite the lack of new investment in the offshore market since the oil price collapsed in 2014, the total investment in “ship-shaped” offshore equipment newbuilding (including modification) between 2009 and 2018 is still as high as US$195 billion, accounting for 18%, even More than a bulk carrier. In addition, 6% of the investment comes from the second-hand ship market outside of bulk carriers and tankers, totaling approximately $60 billion.

By country, Greek shipowners have invested a total of US$136 billion in new shipbuilding and second-hand ships over the past 10 years, ranking first in the world, accounting for about 13%, including 9% of new shipbuilding investment and 4 of second-hand ship purchases. %. This is followed by Chinese shipowners with a total investment of approximately US$127 billion, accounting for approximately 12%; the same total investment of approximately 12% of US shipowners is approximately 1260%, including a large number of cruise ships and Offshore vessel investment. It is worth mentioning that compared with Greek shipowners, investment by Chinese and American shipowners is more concentrated on newbuildings. Japanese shipowners ranked fourth in terms of investment, accounting for about 9%.

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite