Logistics distribution is a mode of operation of the modern circulation industry. The most common is the logistics business. Logistics refers to the process of the flow of goods from the place of supply to the place of receipt; distribution refers to the activities of picking, processing, packing, splitting, and grouping of goods in an economically reasonable area, and delivering them on time to designated locations.

Logistics distribution according to geographical division, can be divided into inter-city distribution, urban distribution, rural distribution; according to the properties of goods can be divided into production logistics and logistics.

The specific types and characteristics of commercial vehicles used in logistics and distribution are as follows: 1) Trucks are divided into four categories: micro-cards (less than 1.8 tons), light trucks (1.8 to 6 tons), and medium-duty trucks (6 tons to 14 tons ) Heavy trucks (over 14 tons). 2) Passenger cars are divided into four major categories, micro-passenger (less than or equal to 3.5 meters), light passengers (3.5 meters - 7 meters), Zhong Ke (7-10 meters), and big passengers (10 meters or more). Can be applied to logistics and distribution: There are four types of trucks, light passengers and micro passengers in passenger cars.

According to the statistical data of energy-saving and new energy automobile networks, in 2015, under the conditions of supply-side improvement and subsidy stimulus, pure electric vehicles witnessed explosive growth. In 2015, the production volume reached 49,500 vehicles, of which the output of pure electric logistics vehicles reached 4. 630,000 vehicles, accounting for 94% of the total.

The electric logistics vehicle is a vehicle-powered transport and storage material unit mobile assembly equipment. Also known as electric vehicle logistics vehicles, electric logistics transfer vehicles, electric cargo turnover vehicles.

Since the government's efforts to support the new energy automotive industry in 2008, the domestic electric logistics vehicle industry has started its journey. On May 6, 2008, the pure electric light truck developed by Dongfeng Motor was put into trial operation in Wuhan and became China's first pure electric light truck.

At present, the mainstream electric-powered logistics vehicles in China are mostly 4-6m models. The target of substitution is traditional miniature and light-duty trucks. The market demand in this area is expected to remain stable overall, and the annual sales volume of conventional vans (miniature and light-weight) is 200. 10,000 vehicles will account for 20% of production and sales of electric logistics vehicles by 2020. By that time, the annual sales volume of electric logistics vehicles will reach 400,000. The annual compound annual growth rate of domestic electric logistics vehicles production and sales is expected to exceed 50% in the next five years. It has a scale of one million vehicles, with an average price of 200,000 yuan per vehicle, which corresponds to a direct market scale of over 200 billion yuan.

According to market research, the average daily mileage of urban logistics vehicles is 150 kilometers, and the average fuel consumption is 8 liters per 100 kilometers. The following are the major considerations for the selection of logistics models for electric logistics vehicles: 1) Continued mileage; 2) Volumetric load; 3) Dynamic performance; 4) Vehicle reliability; 5) Charging convenience; 6) Use cost. Enterprises tend to use electric-powered logistics vehicles that are capable of loading and running, having a cruising range of 200km, a fast-charging time of half an hour, and a purchase price of no more than 200,000 yuan.

At present, the mainstream electric vehicle models on the market have a cruising range of more than 200km and a load of about 1 ton. With the continuous improvement of battery performance, the replacement range of electric logistics vehicles is expected to further expand; in terms of economy, many provinces and cities have already The subsidy policy for electric logistics vehicles was introduced, and the subsidy rate was more or less the same as that of the central government. Under the dual subsidy of the central government and local governments, the purchase cost of electric logistics vehicles has been approaching that of traditional fuel vehicles. Considering the significant reduction in the use and maintenance costs, electric vehicles The comprehensive cost advantage of logistics vehicles is gradually being demonstrated.

It is predicted that by 2020, the scale of the electric logistics vehicle market will reach 58.9 billion yuan, and the compound annual growth rate of revenue will reach 32%. In 2020, the output of electronically controlled electrical machinery reached 369,000 sets, the market size reached 5.1 billion yuan, and the compound annual growth rate of revenue was 27%. The demand for batteries will reach 17.5Gwh by 2020. The market size will reach 24.5 billion yuan, and the compound annual growth rate of revenue will reach 32%.

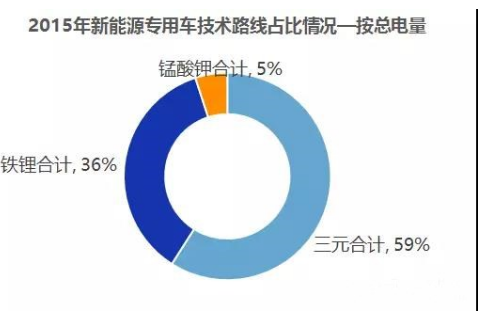

Battery Monomer MarketIn 2015, the new energy special vehicles (most of them are logistics vehicles) have the most powerful power batteries, with the largest proportion of ternary materials, followed by lithium iron phosphate, lithium manganese oxide, and lead-acid batteries.

Lithium manganate batteries have the advantage of good safety, but too low energy density makes them not competitive.

There are not many lead-acid batteries used in electric logistics vehicles. Lead-acid batteries have a short life span, low energy density, and low competitiveness.Power battery supporting PACK and BMS industry

Among the top 24 companies in the 2015 battery supply system integration (PACK) market, there are 15 battery entrepreneurs, 6 car companies, and only 3 professional PACKs, and the supply volume is significantly lower than that of battery companies. From the perspective of market structure, the battery PACK market is relatively decentralized, and the total market share of the top ten companies is only 51%. This is in line with the decentralization of the overall power battery market pattern. It is expected that the market will quickly concentrate on leading enterprises. Among them, Foster's market share is 11%, followed by the market share of Voltmar 10%.

In terms of total supply, the battery plant supplies 80% of logistics vehicles PACKs, and mainly supplies the vehicle companies with the model of battery core + PACK integrated package supply. However, it is not negligible that car companies also provide a 15% battery PACK.

Unlike battery and car companies, which involve a lot of involvement in the PACK segment, professional BMS companies have a large market share in the battery management system (BMS) market. Among them, Ligao New Energy has a market share of 17%, followed by Hangsheng Electronics with a market share of 11%.

From the perspective of market supply structure, BMS plant provided 56% of logistics vehicle BMS, followed by battery plant, and auto supplier BMS ranked third. Looking into the future BMS market, professional third-party BMS companies will still have outstanding competitive advantages, but the stronger car companies may also gradually increase the layout of BMS business.

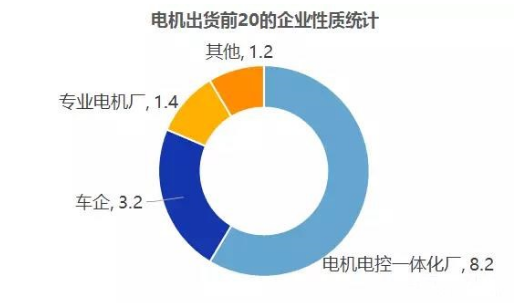

Motor marketThe electrical motor control market for electric logistics vehicles is more concentrated than the battery market. In the drive motor market, the top five companies have a market share of 50.9%. From the perspective of market participants, it mainly includes motor companies, electrical and electronic integration supply companies, car enterprises and other auto parts suppliers.

From the perspective of market structure, the logistics vehicle drive motor is mainly provided by the motor electronic control integration manufacturers and professional motor factories, and the car companies also account for a higher proportion of supply.

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite